-

- admin

- 04.01.2026

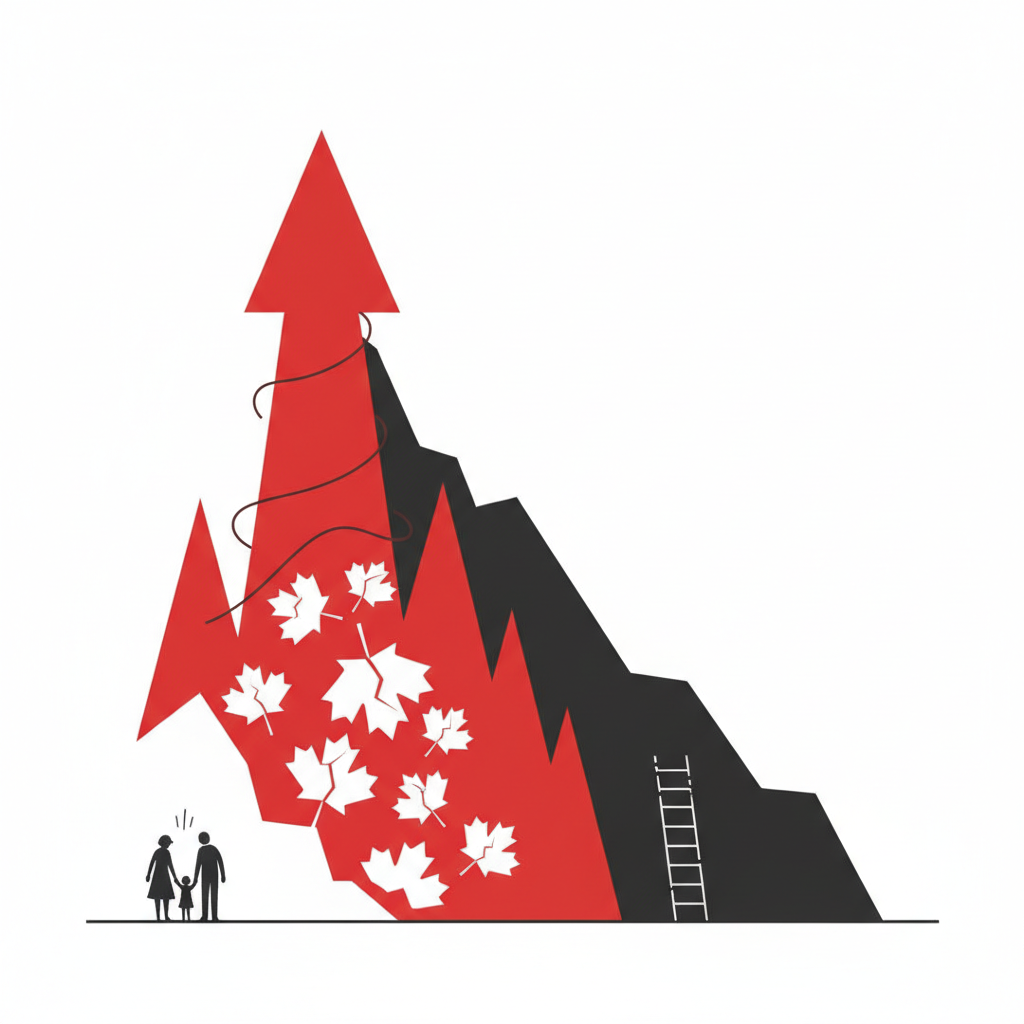

Rising Debt Among Canadians and Possible Solutions: A Detailed Analysis

Almost four in 10 Canadians took on more debt last year, survey shows

A recent report: The OSB and the CAIRP report shows almost 1 in 4 Canadians took on more debt in the last year.

The Financial Consumer Agency of Canada found that more than 54% of Canadians are struggling to pay bills, leading to a record high insolvency rate.

Economist’s view: Moshe Lander at Concordia University points out spending has consistently been higher than income.

Consumer Debt: The debt surged by 18% in the third quarter of 2025, mainly due to car loans.

Average credit card balance in Canada rose by 1.9%.

As per a report from Equifax Canada, consumer debt may further increase during the holiday season.

Loan Defaults: An increase in Canadian loan defaults across non-mortgage loans, severely impacting young households and urban homeowners.

Moshe Lander suggests that low interest rates have hidden the extent of people’s operational troubles post-COVID-19.

Rising interest rates in 2022 have led to severe debt problems for Canadians.

Financial mismanagement: Canadians’ inability to manage their debt has resulted in insufficient savings for emergencies, as indicated by an FCAC survey.

Potential solution suggested by Stacy Yanchuk Oleksy involves Canadians adjusting their saving habits.

The first step towards resolving the issue involves taking an honest look at one’s debts.

Having a budget can significantly influence saving habits.

Debt consolidation: Can simplify debt repayment.

CAIRP recommends other forms of managing debt like a Debt Management Plan and a “consumer proposal”.

Bankruptcy: The last resort to eliminate debts.